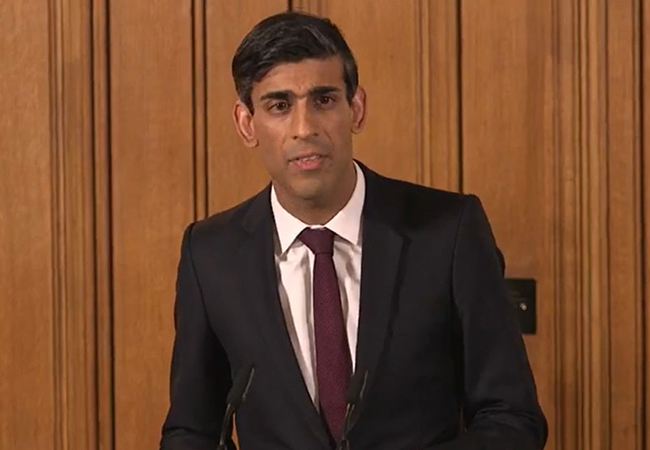

The Chancellor’s ‘Winter Economy Plan’

The Chancellor, Rishi Sunak, announced a new round of emergency economic measures on Thursday 24th September, aimed at supporting businesses and protecting jobs during the second wave of COVID-19. The Winter Economy Plan includes a new Job Support Scheme, an extension of the income support scheme for the self-employed, and flexibilities for businesses on COVID-19-related loan repayments.

Job Support Scheme

The Job Support Scheme will replace the Job Retention – or furlough – scheme, which is set to end on 31st October. Mr Sunak explained that the scheme will be aimed at protecting as many ‘viable’ jobs as possible. It will be launched on 1st November and run for six months.

Under the new scheme, employers will continue to pay the wages of staff for the hours they work – but for the hours not worked, the government and the employer will each pay one third of their equivalent salary. Employees must be working at least 33% of their usual hours. The level of grant will be calculated based on employee’s usual salary, capped at £697.92 per month.

The Job Support Scheme will be available for all businesses across the UK even if they have not previously used the furlough scheme.

For more information: https://www.gov.uk/government/publications/job-support-scheme

Self-Employment Income Support Scheme Grant (SEISS)

The Chancellor also announced that the SEISS scheme, designed to compensate for lost income for the self-employed, will be extended for another six months. Those eligible will receive two lump-sum grants to cover three-month periods over the course of the extension. The instalments will be worth 20% of average monthly profits and will capped at £1,875 in total.

For more information: https://www.gov.uk/guidance/claim-a-grant-through-the-self-employment-income-support-scheme

Loan repayment flexibility

Businesses that took a Bounce Back Loan following the first wave of the virus, will be granted flexibility in their repayment through a new Pay as You Grow system. The length of the loan will be extended from six years to ten, and businesses will be granted access to six-month interest-only periods and payment holidays.

The Government will announce further details on Pay as You Grow in due course.

Emergency Glaziers

Emergency Glaziers GGF Shop

GGF Shop MyGlazing.com

MyGlazing.com Find a GGF Member

Find a GGF Member